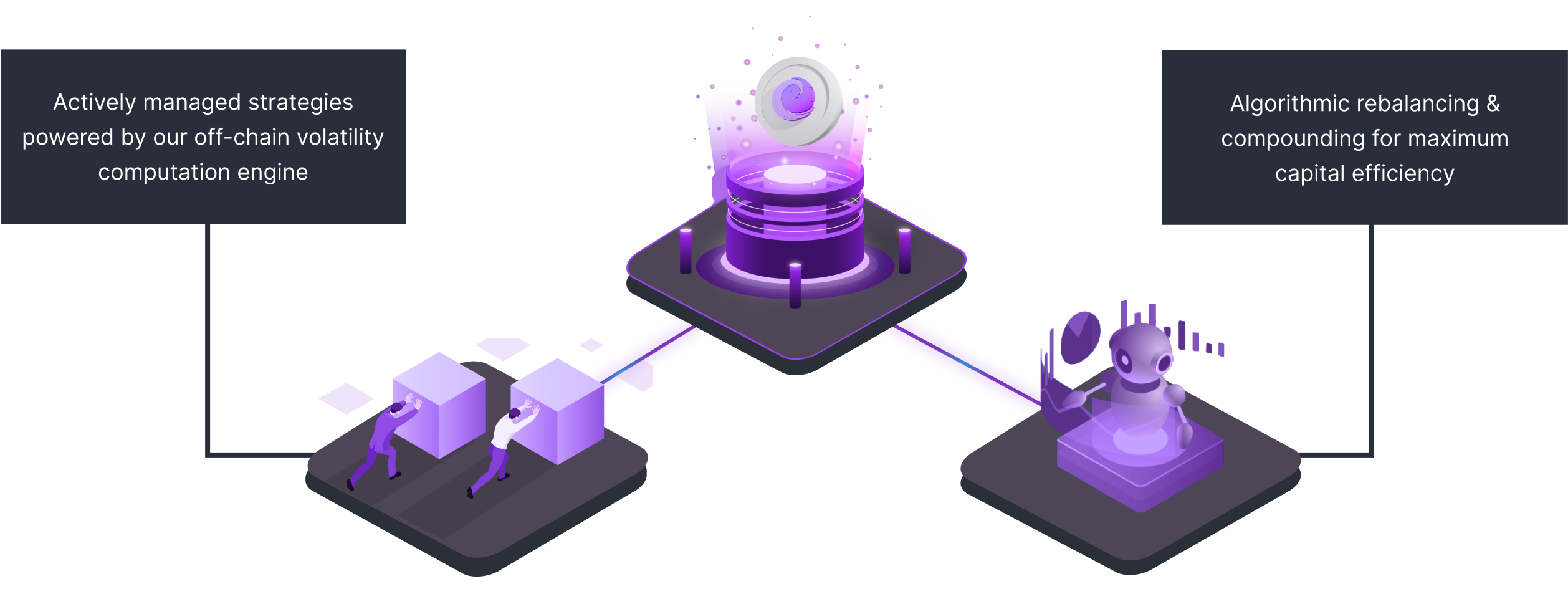

AI-Driven Liquidity Management

Total Value Locked

-

Grants By

New Updates

.png)

.png)

.png)

.png)

.png)